Understanding Your Paycheck Withholdings

When you get your first paycheck, you will be surprised at the various paycheck deductions. It’s important to grasp the breakdown of what’s being withheld and what it’s getting used for. Checks may vary slightly from company to company, So if you have any additional questions, You’ll be able to ask your human resources department.

you ought to remember that some companies run a month behind on paychecks, so any changes in hours, pay or benefits are also a month behind. Once you get a raise you will not see the maximum amount as you thought in your salary, because your rate may go up depending on the dimensions of your raise. Understanding your paycheck can facilitate your understanding of why this happens.

Regular Pay

The amount that you simply acquired the last pay period. This can be the number that you simply are paid before any pretax deductions. If you’re on salary, this could be the quantity that you simply were quoted. Paid hourly it should be capable of the quantity of hours you worked times your hourly wage. If you’re paid every month, then this may likely be the identical amount every month. It’s going to vary from week to week and it’ll affect what proportion is deducted from your taxes.

If you’re paid every fortnight, you’ll find yourself with some extra paychecks annually. It’s important to observe your overtime pay too. Some employers will try and save cash by shaving off some minutes day by day. If this happens, you ought to dispute it. it’s important to carefully document your hours so you’ll be able to compare them to what’s being reported on some time cards.

Other varieties of Pay

Near your regular pay box, you will see boxes labelled with overtime, holiday, and remuneration. This may show the hours you’ve got accrued, or that will come on a separate statement. This may list any of the hours that you just used during this pay period. The overtime wage should be calculated at a time and a half.

It’s important to observe the amount of vacation and sick days you’ve accrued. If you quit your job otherwise you are fired, you must be purchased the times you’ve got accrued. take care to test the policy along with your employer to make sure you receive the quantity you’re due after you leave your job.

Federal Taxable Wages and Withholding

This is the quantity of your paycheck that you simply are taxed on by the central. Your pretax deductions (medical and dental insurance, retirement, and versatile spending accounts) should be subtracted from your regular pay to equal this amount. The withholding amount is the amount of taxes that you just are having withheld.

You’ll be able to also track to work out what quantity was withheld this year thus far. One of the explanations why it’s good to sign on for insurance and nonetheless retirement through your work is that it reduces your taxable income, which implies you’ll pay less in taxes. Take the time to review your benefits package after you start working or during the open enrollment period.

State Taxable Wages and Withholding

The state taxable wages column shows the number that your state will tax you on. The withholding column shows the number that the state withheld. The state taxes are on your net pay rather than your gross pay. If your state doesn’t have income taxes, you’ll not see anything there.

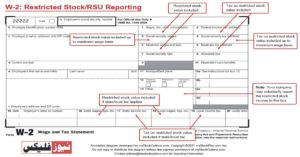

Image Courtesy:mystockoptions

FICA or OASDI Taxable Wages and Withholding

Some companies will talk to this tax as FICA (Federal Insurance Contributions Act) or as OASDI (Old Age, Survivors and Social Insurance Program). These are identical programs. the money that’s taken out is matched by your employer and paid into the Social Security system. You will start receiving a benefit statement from the social insurance system every few years that designates what your benefits are going to be, but this can come through the mail and cut your paycheck.

Miscellaneous Withholdings

You will see several smaller boxes which will be labelled with the assorted other deductions. Which should include insurance, retirement, and any cafeteria plan benefits that you just may have signed up for. Your flexible spending account deductions should be here too. This stuff will kick off before your taxes. And you will be able to reduce your taxable income by signing up for them.

It’s also a decent idea to test to make sure the proper amount is being withheld every month, especially after you first start working. Then if you check the number that you just are paid suddenly changes. If you’re paying for things like your bus pass along with your paycheck. It’ll be listed, as well, though this stuff isn’t tax-deductible. Take care to review your pay stub on an everyday basis to make sure everything is being taken out correctly. So you do not find yourself owing plenty in taxes.